Recap of Houses in Edmonton Canada in 2025

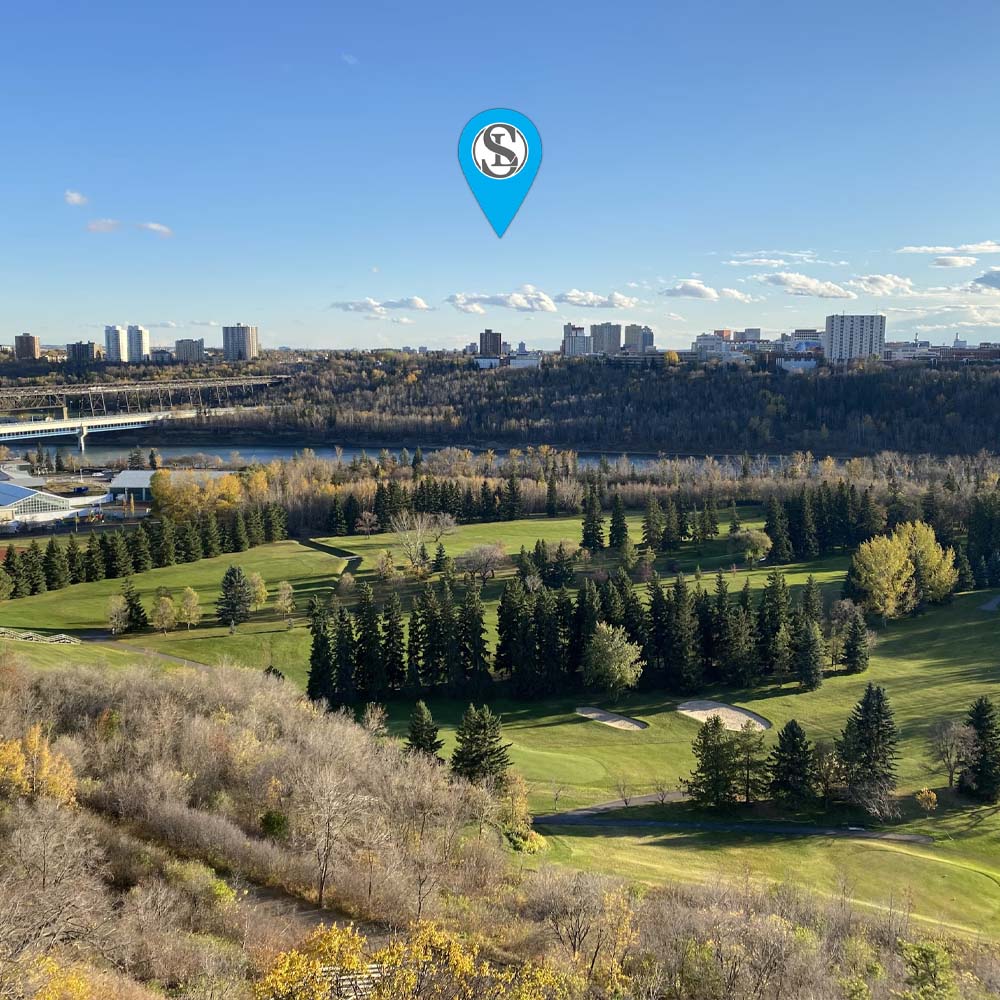

As 2025 comes to a close, it’s a good time to look back at the housing market in Edmonton. This year brought plenty of activity, change, and opportunity for buyers, sellers, and investors. Houses in Edmonton Canada remained appealing for many reasons. Affordability, variety, and strong neighbourhood options kept people interested in the market. From first-time buyers to long-term investors, Edmonton had something for everyone.

Market Trends of Houses in Edmonton Canada

One major trend in 2025 was the continued interest in suburban living. Families and individuals looked for homes with space, safe streets, and easy access to schools. Sherwood Park, South Edmonton, and other family-friendly areas remained popular. Buyers wanted homes with enough room for kids to play, offices for remote work, and backyards for entertaining. Many first-time buyers also focused on affordability. Edmonton offered options that other major Canadian cities could not match, making it easier to enter the housing market without overextending financially.

Downtown Edmonton saw interest from young professionals, empty nesters, and investors. Condos in the city core were sought for convenience, amenities, and lifestyle. People wanted to live close to work, restaurants, and entertainment. Many investors saw downtown condos as a good long-term strategy. Short-term rentals and steady rental income opportunities made this part of Edmonton appealing. The condo market also supported buyers looking to downsize without leaving the city.

Real estate investors found Edmonton attractive in 2025, particularly because of the strong rental demand and room for growth. Population increases in key neighbourhoods created stable opportunities. Smaller properties in emerging areas were popular for entry-level investments. Meanwhile, established homes in sought-after districts appealed to those seeking secure, high-demand rentals. Edmonton proved to be a city where careful planning could lead to strong returns, whether through resale or rental income.

The spring and summer months brought high activity. Buyers were motivated by longer days and pleasant weather to view properties. Summer also gave families time to move between school years. Homes in Sherwood Park and South Edmonton saw strong demand during this period. Sellers who prepared their homes early often achieved better outcomes. Staging, curb appeal, and strategic listing times helped homes sell faster and at higher prices.

Moving into the Third and Fourth Quarters of the Year

Fall and winter saw a shift in strategy. Some buyers slowed down, but those serious about purchasing took advantage of lower competition. Homes listed in October and November sometimes sold more quickly because motivated buyers were ready to act. Seasonal preparation played a key role. Sellers who updated interiors, fixed minor issues, and highlighted energy efficiency stood out. Winter presented challenges, but it also offered opportunities for careful planning and smart timing.

Throughout 2025, neighbourhood trends were important. South Edmonton continued to grow with new builds, parks, and amenities. Sherwood Park kept its family-friendly reputation with top-rated schools and safe streets. Downtown Edmonton condos offered convenience and vibrant city life. Each area had unique advantages, and knowing what matters most to buyers helped guide decisions. Lifestyle considerations, from proximity to work to access to nature, shaped choices across the city.

Edmonton’s market also demonstrated resilience. Even with rising interest rates and global economic shifts, homes remained in demand. Buyers adapted to changing conditions by being selective, prepared, and informed. Investors assessed neighbourhood trends carefully. Sellers focused on improving homes and making them appealing. This balance between preparation and flexibility defined the market in 2025.

Contact us About Houses in Edmonton Canada!

Looking ahead, Edmonton’s housing market is poised to remain strong. Population growth, economic development, and continued urban expansion support steady demand. First-time buyers, families, and investors will continue to find opportunities in the city. Those who plan ahead and understand neighbourhood trends are most likely to succeed. Whether seeking affordability, convenience, or lifestyle, Edmonton continues to offer homes that meet diverse needs.

In conclusion, 2025 highlighted why Edmonton is a city where people want to live, work, and invest. From suburban family homes to downtown condos, the market provided variety, opportunity, and long-term value. Buyers and sellers who stayed informed and prepared often found success this year. As we enter 2026, Edmonton remains a strong, lively city with a housing market full of potential. Contact me today for more information about the new year in Edmonton.

FAQ

What are the most popular neighbourhoods in Edmonton?

Sherwood Park, South Edmonton, and Downtown Edmonton were popular in 2025. Each offers unique benefits for families, professionals, and investors.

Is Edmonton a good city for first-time buyers?

Yes. Edmonton offers affordability, a variety of housing options, and strong neighbourhoods that support families and professionals.

Where should investors focus in Edmonton?

Investors often look at growing neighbourhoods, safe areas, and homes with rental demand. Downtown condos and suburban homes both offer opportunities.