Comparing the Best Areas in Edmonton

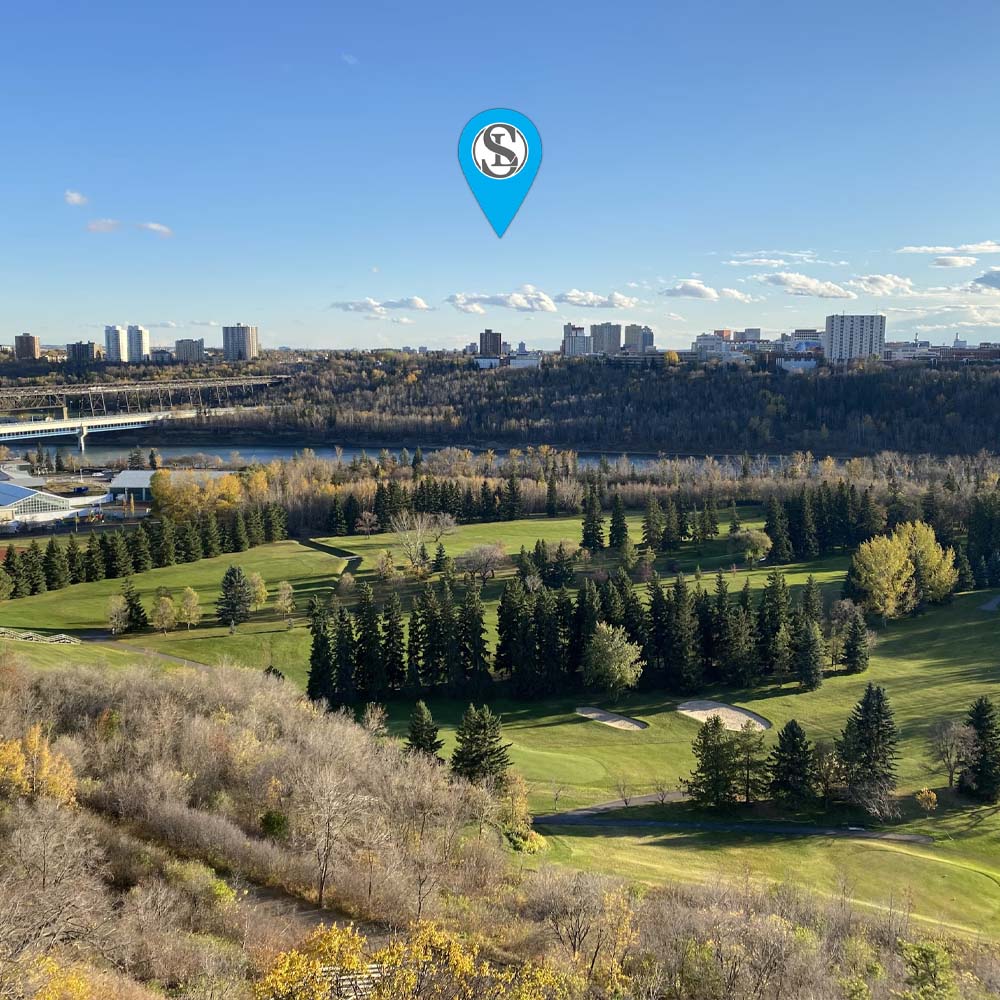

Thinking of moving to Edmonton but not sure where to live? Don’t worry! There are plenty of awesome neighbourhoods in Edmonton that you’ll love to call home. I’ve helped a lot of people determine what areas in Edmonton are the best for them. And, it usually comes down to their lifestyle preferences. Edmonton has many different subareas and neighbourhoods that all offer something different. Whether you’re keen to be in the city centre or the quiet of the suburbs, there’s a place for you! In this post, I’ll break down three of the most popular areas in Edmonton: Downtown, Sherwood Park, and South Edmonton. Follow along below to learn more!

What You Get in Each Area

Edmonton’s neighbourhoods vary a lot, and what works for one person might not work for another. Downtown Edmonton is driven by a sense of energy and convenience. If you want to live close to your job, love eating out, or want access to nightlife and arts, this area delivers. Most homes here are condos and apartments. You’ll find high-rises, older character buildings, and some newer developments. It’s great for singles or couples who are looking to be in the action!

Sherwood Park, while technically outside Edmonton’s city limits, feels like a city within a city. It’s full of parks, schools, and families. You’ll find mostly detached homes, many with big yards and room to grow. The roads are quieter, and the pace is slower. It’s your typical suburban setting, which is ideal if you’re raising kids or intend to start a family.

South Edmonton is where a lot of new development is happening. It’s perfect for first-time buyers who want to invest in a new home without paying downtown prices. You’ll see newer communities like Summerside or Rutherford popping up, home to townhomes, duplexes, and some detached homes.

Who Each Area is Best For

Downtown is for those who want to ditch their car, participate in the action, and don’t need a lot of space. If you work in the core and want the ability to walk to your favourite brunch spot or take in a concert at Rogers Place, then downtown will suit you. You’ll trade yard space for location, but if you’re not worried about mowing grass or fixing fences, it’s a pretty good deal. Plus, condo life means less maintenance and added amenities like gyms and rooftop patios.

Sherwood Park is for those who want space to spread out and enjoy a slower pace of life. Families, retirees, or anyone seeking quiet comfort will feel at home here. The schools are excellent, the streets are clean, and the neighbours are friendly. Sherwood Park feels a lot like a small town within the city, which is great because you still get access to all of the services that come with being near a major metropolitan centre. Living here means needing a car, but for many folks, that’s no issue. If you’re the kind of person who enjoys a backyard barbecue, a short walk to a playground, and not worrying about parking, check out homes in Sherwood Park!

On the other hand, South Edmonton is for those just getting started. For instance, new homeowners, young couples, or anyone who wants a modern home without a steep price tag. The neighbourhoods in the south are newer, which often means energy-efficient builds, updated finishes, and less surprise maintenance. Many of the communities are built with parks, schools, and shopping nearby. It’s a great place to grow into, and because these areas are still developing, you’ve got room to move up in the future without changing postal codes.

How to Choose the Right Area for You

Once you’ve got a feel for the areas that you think will suit you best, it’s time to start making decisions. Start this process by working out your budget. It’s not the most exciting part, but it’s a critical component that will help you temper your expectations and narrow your search. This will help prevent you from falling in love with a house that is out of your price range. Each area has different price points and property types, so narrowing it down first makes life easier.

You’ll also want to think about your commute. If you’re working downtown, living in Sherwood Park or South Edmonton will mean a drive. Some folks don’t mind it, especially if they love their neighbourhood. But others can’t stand traffic. You’ll have to weigh the pros and cons and determine what the best choice is for you.

Next, you’ll want to consider your lifestyle. Do you need green space? Do you want to walk to the shops? Do you host family often? These details should guide your decision. After all, if you love to host and entertain, an apartment may not be the best fit. Similarly, if you’re travelling all of the time, you probably don’t want to look after an entire detached home.

When planning your purchase, do keep the future in mind. If you plan to have kids soon or anticipate upsizing/downsizing, you’ll want to determine how this affects what kind of home you should buy. Try to picture your life three to five years from now. The right neighbourhood should be able to grow with you, or be easy to move out of when the time comes.

Contact me to Decide What Areas in Edmonton are Right for You!

Choosing the right areas in Edmonton is a big decision. Whether you’re drawn to the bustle of Downtown, the comfort of Sherwood Park, or the newness of South Edmonton, there’s a place that fits your life. If you’re not sure where to begin, contact me today! I look forward to helping you find the perfect home. Be sure to check out my social media for the latest updates and more!

FAQ: Best Areas to Live in Edmonton for Your Lifestyle

What are the best areas to live in Edmonton?

Some of the best areas to live in Edmonton include Downtown Edmonton, Sherwood Park, and South Edmonton. Each neighbourhood offers a unique lifestyle—whether you’re looking for urban living, family-friendly suburbs, or newer communities for first-time buyers.

Is Downtown Edmonton a good place to live?

Yes, Downtown Edmonton is great for people who want to live close to work, enjoy nightlife, dining, and cultural events. It’s ideal for singles or couples who prefer low-maintenance condo living and access to transit, restaurants, and entertainment.

What is it like to live in Sherwood Park?

Sherwood Park offers a quieter, suburban lifestyle with lots of green space, schools, and detached homes. It’s perfect for families, retirees, and anyone who values space, safety, and a slower pace, while still being close to Edmonton.

Is South Edmonton good for first-time homebuyers?

Yes, South Edmonton is popular with first-time buyers. Many neighbourhoods, like Summerside and Rutherford, feature new builds, townhomes, and duplexes at more affordable prices than the city centre. These areas offer modern homes and family-friendly amenities.

Which Edmonton neighbourhood is best for young professionals?

Downtown Edmonton is the top choice for young professionals who want to live close to work, enjoy an active social life, and skip long commutes. Condos with amenities like gyms and rooftop patios are common in this area.

Is Sherwood Park part of Edmonton?

No, Sherwood Park is not officially part of Edmonton—it’s a community in Strathcona County. However, it functions like a suburb and is only a short drive from the city, making it a popular choice for families who want more space and a suburban setting.

What is the commute like from Sherwood Park or South Edmonton to Downtown?

Commuting from Sherwood Park or South Edmonton to Downtown typically involves a drive, which can vary in length depending on traffic. Many people find the trade-off worth it for quieter neighbourhoods and larger homes.

How do I choose the right Edmonton neighbourhood to live in?

To choose the right neighbourhood in Edmonton, consider your budget, commute, lifestyle, and future plans. Ask yourself if you want an urban vibe, quiet streets, proximity to schools, or newer construction. It’s also smart to work with a local real estate expert who can guide you.

Where can I find help deciding where to live in Edmonton?

You can contact a local real estate professional, like Steve Leddy, who knows the Edmonton area well. They can help you assess your lifestyle, needs, and future goals to recommend the right neighbourhood. Reach out today to start your home search with expert advice!