Edmonton Luxury Real Estate is Forecasted to Boom in 2024

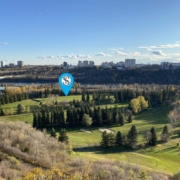

Canada’s luxury real estate market remained relatively quiet throughout 2023. However, this year, experts are predicting that luxury homes will start to pick up the pace in terms of sales in the months to come. With interest rates at all-time highs last year, it’s no surprise that several Canadians put a pause on purchasing luxury assets. Now that interest rates are steadying, and rumours of decreases are circulating, eager buyers and investors are looking to make their move on high-end properties. Edmonton, Toronto, Montreal, Calgary, and Vancouver are among the cities looking promising for luxury property transactions in 2024. In this article, I will focus on the Edmonton luxury real estate market and provide some advice for those considering entering the market this spring. Follow along below to learn more!

The 411 on Edmonton Luxury Real Estate

During the bulk of 2023, luxury market sales struggled. Now that mortgage rates are stabilizing, Edmontonians who have been waiting for the right opportunity to purchase, are impatiently waiting to capitalize on the potential upswing in luxury property transactions.

According to data from the REALTORS® Association Edmonton, the activity in this sector of the market was the lowest it’s been since 2020. This is in part due to the fact that many luxury property buyers were moving away from investing in condos. Rising fees associated with condos led to a perceived increase in value for single-family homes. Consequently, buyers found it more appealing to invest in detached houses than condominiums.

Edmonton’s neighbour and rival to the south, Calgary, saw tremendous growth in its luxury sales during 2023. Homes with values over $1,000,000 saw sales increases of 13% year-over-year. All the while, properties valued at $4,000,000 and above witnessed a 50% jump in sales year-over-year. Not surprisingly, 88% of these purchases were single-family homes. Although, condo sales in Calgary also remained fairly steady, growing 16% year-over-over. It’s worth noting that the majority of the activity in this sector occurred during the latter half of the year.

Similar to Calgary, Edmonton also recorded strong activity from the second half of the year onward in the luxury market. This is mainly due to the fact that the luxury market in Edmonton starts at $1,000,000. As a result, it is much easier for buyers to purchase high-end properties compared to cities like Vancouver or Toronto.

The affordable price tag on luxury properties in Edmonton has been an attractive factor for out-of-province buyers and investors. For those used to the cost of housing in B.C. or Ontario, the value of real estate in Edmonton seems like a bargain.

Tips for Investing in Luxury Properties

- Find Your Limit

When investing in luxury properties, it is critical that you know your limit in terms of price. Having a clear-cut budget is essential as you work towards marking a purchase. Luxury properties are often more expensive to maintain than your average single-family property. This is because many come with additional amenities and features that you wouldn’t normally have with homes in the regular market. Not to mention the average listing price will also be higher than usual. Getting pre-approved for a mortgage is a great first step to take.

- Choose a Great Location

Location is paramount with luxury real estate. Especially, if you have plans of reselling or operating a business out of your home. You’ll want to ensure that your luxury property is zoned in accordance with your intended uses and in a place where future buyers would consider it to be an attractive investment. Choosing a home that’s near great shopping, dining, educational institutions, or a recreational experience is ideal. Talk with a real estate agent to determine what area is best for you!

- Work With a Trusted Agent

One of the best things you can do when investing in luxury real estate is to work with a REALTOR®. A trusted agent is going to know the ins and outs of the local market. This can ensure that you get the best deals, information and advice as you work toward accomplishing your goal. When buying a luxury property, it is often hard to determine a fair price. With the help of an agent, you can guarantee that you are getting the best value for your money.

Contact me Today!

Choosing to invest in Edmonton luxury real estate is an exciting endeavour. Contact me today to learn more about the luxury market in this area. I’d be happy to answer any questions you have about how to achieve your 2024 real estate goals. Feel free to reach out to me at any time! Be sure to check back next month for more real estate-related information. I look forward to working with you in the near future.