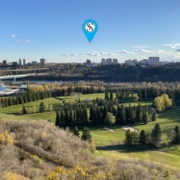

Real Estate Sherwood Park: New Bremner Hydrogen Powered Community

Those living in real estate Sherwood Park should know that a new development is coming soon to their neighbourhood. However, this development isn’t your average suburb – it will be a community purely powered by hydrogen. This development is called Bremner, and it is set to begin construction right away. Bremner will mark the first hydrogen-powered community in Canada. This innovative approach to energy use aims to reduce carbon emissions and pave the way for more sustainable living options in the future. Residents of Bremner can look forward to a cleaner, greener community that sets a new standard for environmentally friendly living. In this article, we will be going over everything that you need to know about the new Bremner community. Follow along below to learn more!

Some Background on the Bremner Project

The Bremner project was approved by the Strathcona County Council in 2023. This came after a series of rezoning approvals and subsequent rejections. However, the project was ultimately given the go-ahead. Strathcona County had long been considering Bremner as a potential location for development. Despite this, there was minimal interest until a decade ago when talk of population increases spurred a need for new accommodations.

Qualico and ATCO are the two main proponents behind Bremner. For those who don’t know, Qualico is a housing development company operating in Western Canada and the US. They work on home-building projects, land acquisition, commercial and community development, and property management. On the other hand, ATCO is a premier corporation in Canada engaged in structure and logistics, electricity, pipelines and liquids and retail energy. Like Qualico, ATCO has various subsidiaries across the globe, stretching from Canada to Australia.

In February of 2023, Alberta Innovates gave ATCO $2 million to conduct feasibility studies for the proposed Bremner project. ATCO Gas president, Jason Sharpe, noted that the study would examine what infrastructure is needed to get hydrogen into homes, what the regulations would be and how it would be priced for consumers. The feasibility study was aimed to provide recommendations to the government on how hydrogen-powered homes can be rolled out. This way, buyers can get a clear idea of what these houses will cost.

While many Edmontoners have been supportive of the Bremner project, it has been a source of controversy from day one. Critics have mentioned the loss of good agricultural land, county infrastructure costs and premature timing. However, with Bremner being given the green light, this project has the potential to accelerate Canada’s development in hydrogen power.

Details About Bremner Near Real Estate Sherwood Park

So what’s the big deal about Bremner anyway? And, what do ATCO and Qualico mean by a hydrogen-powered community? Well, Bremner will be the first hydrogen-powered community in Canada and the largest in the world. The only other hydrogen-powered community of any scale now is in the Netherlands. In Bremner, hydrogen power will be used exclusively for heating purposes. It will effectively replace natural gas with a much more environmentally friendly alternative.

In an interview on April 18, 2024, Greg Caldwell (ATCO Gas) and Brad Armstrong (Qualico Communities) discussed some of the questions that Sherwood Park residents have been asking. One of these questions included the cost difference between hydrogen power and natural gas. This is an important topic given the state of interest rates and Canada’s current cost of living. Both Caldwell and Armstrong assured that there is little cost difference between natural gas and hydrogen power. Consequently, making the switch relatively unnoticeable from a financial perspective.

By using hydrogen in place of natural gas, homes will not only be safer but also greener. With natural gas, there are various byproducts created when it is burned. For example, carbon emissions and greenhouse gasses. It also brings about the risk of carbon monoxide poisoning, which is responsible for 300 Canadian deaths per year. On the contrary, when burning hydrogen the only excess is water.

Bremner developers anticipate that the first resident will be able to move into the community by 2026. However, development will continue over the next 50 years, eventually resulting in over 37,000 homes, businesses and other amenities. Bremner is being constructed on 5,000 acres of land and is rumoured to house 85,000 residents upon completion.

Contact us About Real Estate Sherwood Park

There are lots of new and exciting developments in the works in Edmonton and surrounding areas. Contact me today to learn more about real estate Sherwood Park. I’d be happy to answer any questions you have about how to achieve your 2024 real estate goals. Feel free to reach out to me at any time! Be sure to check back next month for more real estate-related information. I look forward to working with you in the near future.